Find Your Perfect Business Degree

www.business-management-degree.net is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.

Becoming part of the world of business is a professional experience like no other. It entails a wealth of tasks and responsibilities to keep operations running on a day-to-day basis. It’s fair to say without competent professionals to do their job, a business will eventually crumble.

Business terms are essential concepts that are used in the world of business. Understanding these terms and concepts is essential for business students, as they will be able to apply them to their studies, careers, and everyday lives.

Business professionals prepare financial statements, attend client meetings, impress a potential partner, and fulfill other functions. While getting the best education to prepare you for the business setting, you are expected to learn as much information as you can to meet your obligations as a future expert.

As a fundamental requirement, business students must be acquainted with basic business vocabulary. Almost exclusive to business communication, specific terminologies enable parties to hold a clear conversation without having to explain or elaborate on what they mean or verify that the information is understood.

It is important for students to become familiar with the vocabulary they will come across throughout their business education, whether they are beginning their studies or have already had some experience in the field.

Here are ten essential business terminologies that every business student should become familiar with.

Assets

The term “asset” refers to any resources with an economic value that a business owns. It may also point to finances and other valuables that belong to an individual or a particular company. An asset can help generate revenue, increase business value, and facilitate business operations. Simply put, an asset can be converted to cash.

An asset can be classified into tangible and intangible. Tangible assets include buildings, currencies, and equipment that have a physical substance. Intangible assets can consist of copyrights, trademarks, franchises, and tradenames. In business transactions, assets are part of the accounting equation and the balance sheet, which are expressed in the following format:

Assets = Liabilities + Owner’s Equity

As you identify your assets, it is crucial to evaluate the net worth of your business. Doing this helps business owners to determine whether to sell their business or file for bankruptcy.

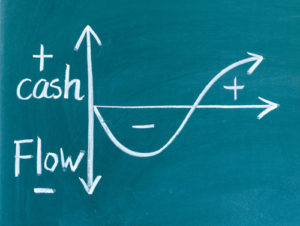

Cash Flow

The overall movement of your business finances each month, including income and expenses, is called cash flow. The cash flow for a company is divided into three parts. Operating Cash Flow refers to those from internal activities of a company such as a employee’s salary. Investment Cash Flow involves the business’ fixed assets, such as the finances to buy a piece of new equipment. Finally, for the business’ financing transactions such as payment of dividends and issuance of stock, it is called Financing Cash Flow.

“Positive” cash flow reflects a higher flow of finances into the company rather than an outflow of expenses from the company. When customers purchase your products directly, cash flows into your business. On the opposite side, cash flows out of your business (negative) to pay for taxes, rent, and utilities.

Expenses

An outflow of cash and other assets from one company to another is called Expense. It is the ordinary and necessary costs that are incurred to run a business or trade. Expenses can be applied to small companies or large entities. It can also be defined as either capital or an income, depending on the interpretation of its use.

In business, expenses are part of your statement of income. These are the finances that are needed each month for the company to operate. It includes legal costs, worker’s salary, marketing costs, and rent. It is recommended for a business to keep its expenses as low as possible to stabilize the financial status of a company. An expense report documents the costs incurred in the business operation.

Liabilities

In business, Liabilities are the opposite of Assets. They are debts and financial obligations owed to another person or entity from a past transaction. In their account title, it can be commonly labeled as “payable.” Your liabilities are reported in a balance sheet and separated into two categories: current liabilities and long-term liabilities.

Current, or short-term, liabilities are immediate debts that need to be repaid within one year, which include taxes, wages, and accounts payable. Meanwhile, long-term liabilities can be repaid over a year, such as mortgages, business loans, and pension obligations.

Liabilities are an essential aspect since they are used for operations to finance the overall enterprise. They are also used to pay for business growth and expansions. For example, when an outsourced company is supplying goods to your business, the outstanding bill that you owe to the outsourced company is considered a liability. In contrast, that company can consider the bill it is owed as an asset on its end.

Gross Profit

A profit of a company after deducting the costs of making a product or providing a service is called Gross Profit. It is sometimes referred to as gross income or sales profit. This can be computed after subtracting the cost of goods sold (COGS) from revenue (sales) and will be available as your company’s income statement. This measures a company’s financial performance in managing the demand and supply of goods and services associated with the production and sales of products and services.

As presented in an income statement, if the constructor has net sales of $40,000 and its cost of goods sold is $15,000. Henceforth, the constructor’s gross profit is $25,000 ($40,000 minus $15,000). The gross profit ratio or gross profit percentage is 63% (gross profit of $25,000, divided by net sales of $40,000).

Revenue

Revenues are the lifeblood of any business. It is the income generated from business operations of selling goods and services to customers in a given period. Revenue is commonly referred to as sales and can be received in the form of cash or cash equivalents. Because it is the money brought into the company, it is critical early to get positive revenues in the initial start-up of any business.

In an income statement, revenue appears first, where net income is at the bottom line. Thus, it is expressed as revenues minus expenses since there is a profit when revenues are higher than the expenses. If a business does not have enough revenue, then it needs to use an existing cash balance.

Net Income

An indicator of your company’s profitability, whether increasing or decreasing, is called net income. Also referred to as net profit, it reveals how much revenue is left after all business expenses have been paid. It is calculated as sales minus the cost of goods sold, tax interests, and all other operating expenses. Since it appears at the bottom of the income statement, businessmen refer to this measurement as the bottom line.

Being a proper measurement of the business’s financial standing, many people tend to pay attention to net income calculation. This can give them an idea that their investment continues to appreciate, can pay off its debt, and is able to pay the salaries of employees.

Return on Investment (ROI)

A standard indicator of an investment’s performance is the Return on Investment (ROI). By definition, it is the ratio between net profit relative to its cost of investment. It is used to assess the performance of investment portfolios wherein higher ROIs are potential candidates for new investments. With higher financial returns, new funds are allocated. Conversely, negative ROIs mean a net loss.

If, for example, you invested $2,000 in a Southern Fried Chicken Company in 2018. You should get your stock shares for $2,200 after a year. To compute your ROI, you would divide your profits ($2,200 – $2,000 = $200) by the investment cost ($2,000), for a ROI of $200/$2,000, or 10 percent. With this, you can value your investment not just for financial return but also the long long-term profitability.

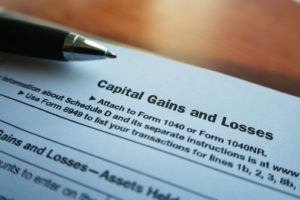

Capital Gain

When the current price of an asset exceeds its purchase price, it is called Capital Gain. This can be attributable to, but not limited to, shares, stocks, and mutual funds. A capital gain can be considered either a realized or unrealized gain. The gain from the final sale of an investment or asset is called realized gain. If unsold, it is treated as Unrealized Gain.

In any business venture, it is vital to have an idea of how your profits will be taxed. As an example, if you bought a $300,000 real estate and sold it for $650,000, your total capital gain is $350,000. However, it varies on the length of time the asset was acquired, specific investment, and the rate of your personal tax income.

Income Statement

For a business to be financially stable, it must generate more revenue from the sale of its products and services. An INCOME STATEMENT is also known as a Profit and Loss Account. It is a financial statement showing a business’s revenues and expenses in a given period. Usually, it is expressed either in a fiscal year or a full calendar year. This is done by taking all revenues and subtracting all operating and non-operating expenses.

Because it plays a vital role in the company’s performance reports, it highlights four essential items- revenue, expenses, gains, and losses. It also conveys a detailed insight into the business’ internals and success parameters in comparison to other companies and sectors.

With income statements, upper-level management can make business decisions to increase production capacity, expand to a new location, or terminate product sales. As a bottom line, through this, the financial performance of the company can be gauged if they can be able to generate profit.

Why is it important to know business terms?

Knowing business terms helps us better understand business operations and decisions. It equips people with the vocabulary they need to effectively communicate with colleagues, clients, or vendors. By expanding their business vocabulary, people are able to read, assess, and discuss complex documents, financial statements, and legal contracts in an effective and accurate manner, enabling them to make well-informed decisions.

How can I learn business terminology fast?

- Utilize online tutorials and courses. There is a plethora of online courses and tutorials available that can help you expand your business terminology quickly.

- Read business publications. Business publications are a great way to become familiar with the terms and phrases used in the business world.

- Network with industry professionals. Talking to people who are experienced and knowledgeable about the industry you’re in can help you learn the terms quickly.

- Ask questions. Don’t be afraid to ask questions if you come across a term you don’t recognize and can’t figure out. Asking questions is one of the best ways to learn new terms.

How can I sharpen my memorization skills?

- Practice active recall. Active recall is actively trying to remember information without the aid of notes or books.

- Take practice tests. Taking practice tests is a great way to sharpen your memorization skills. This will not only help you gain a better understanding of the material but can also help you retain the information.

- Associate facts and ideas. Associating facts and ideas can make it easier to recall information. Try connecting the information to visual cues, facts, or stories that will help you remember.

- Practice spaced repetition. Spaced repetition is a technique where you review information over short periods of time. This allows you to refresh your memory, making it easier to remember the material.